Have you ever wondered why health insurance policies come with a waiting period, especially for pre-existing diseases? Many people assume that their medical coverage plans will take care of their health needs immediately, but this isn’t always the case. Understanding the waiting period for pre-existing diseases is crucial when selecting a health insurance policy. This period determines when coverage for existing medical conditions begins, impacting your financial planning and access to healthcare services.

What are Pre-existing Diseases covered (PED) in Health Insurance?

Pre-existing diseases (PED) in insurance refer to medical conditions, ailments, or injuries that have been diagnosed or treated within a specified timeframe before purchasing a health insurance policy. In India, the Insurance Regulatory and Development Authority of India (IRDAI) defines a pre-existing disease as any condition for which medical advice or treatment was recommended or received within 48 months before the policy’s commencement.

PED Waiting Period in Health Insurance

The PED waiting period is the duration during which an insurer does not cover claims related to pre-existing diseases. This period typically ranges from 12 to 48 months, depending on the insurer’s policies and the specific health condition.

In a significant move, the IRDAI reduced the maximum waiting period for pre-existing diseases from 48 months to 36 months, effective from April 1, 2025. This change aims to make healthcare coverage more accessible and beneficial to policyholders with existing health conditions.

Health Insurance Without Waiting Period for Pre-existing Diseases

Some policies offer zero waiting period health insurance, ensuring immediate coverage for existing conditions. However, these plans often come with higher premiums.

How Zero Waiting Period Health Insurance Works

In a zero-waiting period, health insurance coverage for pre-existing conditions starts from the policy’s inception. Policyholders can claim expenses related to their existing ailments without any delay. It’s essential to disclose all medical conditions accurately when purchasing health insurance courage to avoid claim rejections.

Benefits of No Waiting Period Health Insurance

Opting for health insurance with no waiting period provides:

- Immediate Medical Insurance Coverage: Access treatment without delay.

- Financial Security: Reduces personal expenses.

Peace of Mind: Ensures courage in medical emergencies.

How to Choose the Best Health Insurance for Pre-existing Conditions

When selecting pre-existing disease health insurance, consider the following:

- Assess Your Health Needs: Know your conditions and their severity.

- Compare Policies: Seek plans with shorter PED waiting periods or waiver options.

- Check Premiums: Balance premium costs with the benefits offered.

- Read the Fine Print: Understand terms, conditions, and exclusions.

- Claim Process: Choose an insurer with a smooth claim and efficient claim process.

Why Does Health Insurance Have a Waiting Period for Pre-existing Conditions?

Insurers implement waiting periods to mitigate the risk of immediate high-cost claims from new policyholders with existing health issues. This practice helps maintain the financial stability of insurance pools, ensuring that resources are available for a broader range of claims.

Understanding the Different Types of Health Insurance Waiting Periods

Health insurance policies may include various waiting periods:

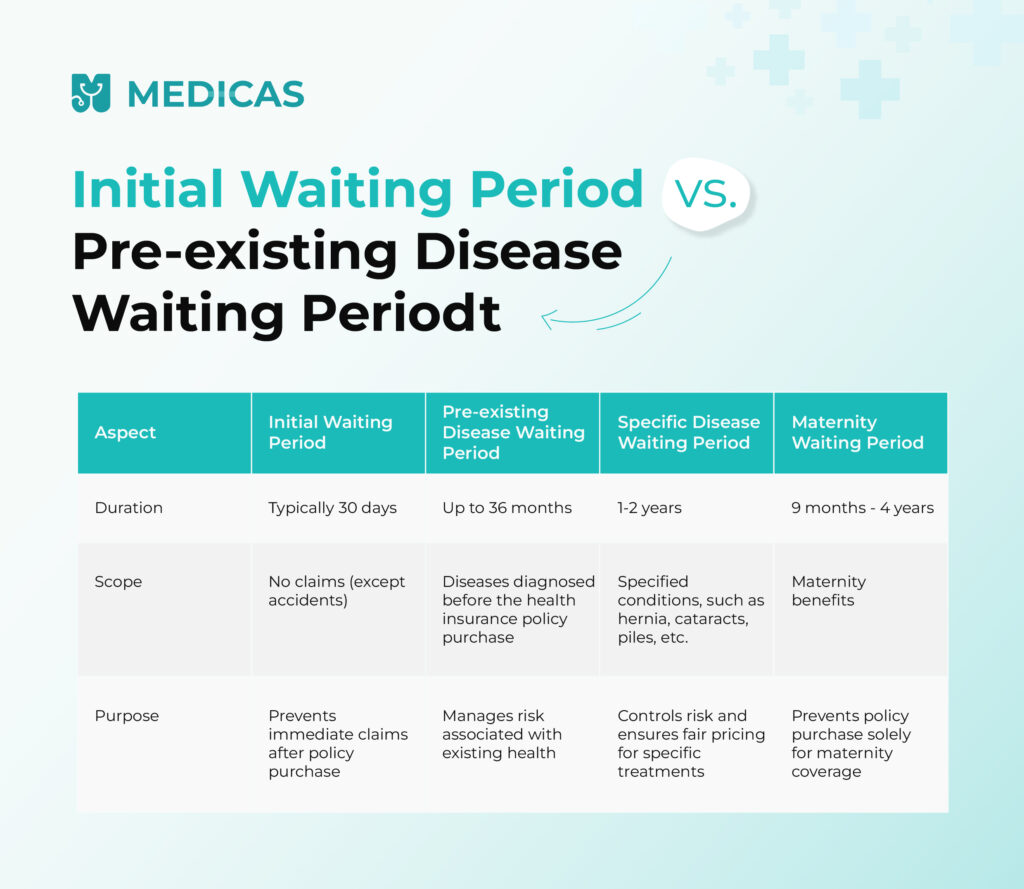

Initial Waiting Period vs. Pre-existing Disease Waiting Period

Understanding these waiting periods helps you select a policy that aligns with your healthcare needs.

Cooling-Off Periods and Their Impact on Claims

A cooling-off period refers to a timeframe during which certain health insurance benefits are not available, even after the initial waiting period. For instance, specific treatments or surgeries might have a cooling-off period, affecting when you can claim these benefits.

What Happens If You Need Treatment During the Waiting Period?

Generally, you will have to bear the expenses yourself during the PED waiting period.

How to Handle Medical Emergencies During the Waiting Period

It’s advisable to plan for such scenarios by:

- Saving emergency funds.

- Exploring employer health benefits.

- Seeking hospital payment plans or financial assistance programs.

- Considering government healthcare schemes or community health centres.

Additionally, you might consider home remedies, online doctor consultations, or medical coverage plans with pre-waiting period benefits.

Can You Reduce the Waiting Period for Pre-existing Diseases?

Yes, some insurers allow policyholders to reduce the waiting period through:

Exploring Waiver Options and Riders for Waiting Period Reduction

- Riders: Additional benefits purchased at extra cost to shorten or eliminate the waiting period.

- Waivers: Some policies offer waivers for specific conditions, reducing the waiting period upon payment of an additional premium.

Impact of Choosing a Higher Premium on Waiting Periods

- Reduced Waiting Periods: Immediate or faster coverage for pre-existing conditions.

- Enhanced Insurance Benefits: Access to a broader network of hospitals and services.

Common Pre-existing Conditions Covered Under Health Insurance

Many chronic conditions are now covered after the PED waiting period.

Chronic Conditions Typically Covered in Health Insurance Plans

- Diabetes

- Hypertension

- Heart Disease

- Asthma

- Thyroid Disorders, etc.

Conditions That May Not Be Covered by Health Insurance

Some conditions might be excluded or have extended waiting periods:

- Pre-existing Terminal Illness

- Certain Mental Health Disorders

- Cosmetic or Elective Surgeries, etc.

How to Check the Waiting Period in Your Health Insurance Policy

Steps to Verify Waiting Period Clauses in Your Policy

- Review your policy document’s waiting period section.

- Contact your insurer for clarifications.

- Consult an insurance advisor.

Understanding the Fine Print: Key Points to Look Out For

- Pre-existing condition definitions.

- Waiting period durations for various ailments.

- Policy exclusions.

Conclusion

Understanding the PED waiting period and other waiting periods in health insurance aspects is essential for maximising your health care coverage and medical coverage. Choosing the right health insurance for pre-existing conditions requires careful research and comparison.

Frequently Asked Questions (FAQs) on waiting period for pre-existing diseases

Can I consult an online doctor to manage pre-existing conditions during the waiting period?

Yes, you can opt for an online doctor consultation through Medicas to manage pre-existing conditions during the waiting period. With Medicas, you can get medical advice and prescriptions for managing your condition.

Are online doctor consultations covered under health insurance?

Whether online doctor consultations are covered under your insurance benefits depends on your specific policy. Check your policy documents or contact your insurer to confirm if this benefit is included in your health coverage

How can I book an online doctor consultation for pre-existing disease management?

You can easily book an appointment with a doctor through online platforms like Medicas. You can book lab tests and filter doctors based on their specialisation and experience in managing specific pre-existing conditions.

How can I check if my insurance plan includes online doctor consultations?

Check your policy documents for telehealth/telemedicine coverage. If unclear, contact your insurer directly. Inquire about pre-existing disease coverage too.

Related Blogs

Disclaimer

Medical Advice: The information provided in this blog post is for educational purposes only and should not be considered as a substitute for professional medical advice, diagnosis, or treatment. Always consult with a qualified healthcare professional for personalized guidance regarding your specific medical condition.

Accuracy of Information: While we strive to provide accurate and up-to-date information, the field of medicine and viral fevers is constantly evolving. The content in this blog post may not reflect the most current research or medical guidelines. Therefore, it is advisable to cross-check any information provided with reliable sources or consult a healthcare professional.

Individual Variations: The symptoms, causes, treatment options, and preventive measures discussed in this blog post are general in nature and may not apply to everyone. It is important to remember that each individual’s situation is unique, and personalized medical advice should be sought when making healthcare decisions.

External Links: This blog post may contain links to external websites or resources for additional information. However, we do not endorse or have control over the content of these third-party websites. Accessing these links is done at your own risk, and we are not responsible for any consequences or damages that may arise from visiting these external sources.

Results May Vary: The effectiveness of treatment options or preventive measures mentioned in this blog post may vary from person to person. What works for one individual may not work the same way for another. It is essential to consult with a healthcare professional for personalized advice tailored to your specific needs.